louisiana inheritance tax return form

It is indexed for inflation and for deaths occurring in calendar year 2020 the exempt amount is 1158 million for an individual and twice that for a married couple. Revised Statute 472436 requires that an estate transfer tax return be filed by or on behalf of the heirs or legatees in every case where estate transfer tax is due or where the value of the deceaseds net estate is 6000000 or more.

Free Louisiana Small Estate Affidavit Form Pdf Formspal

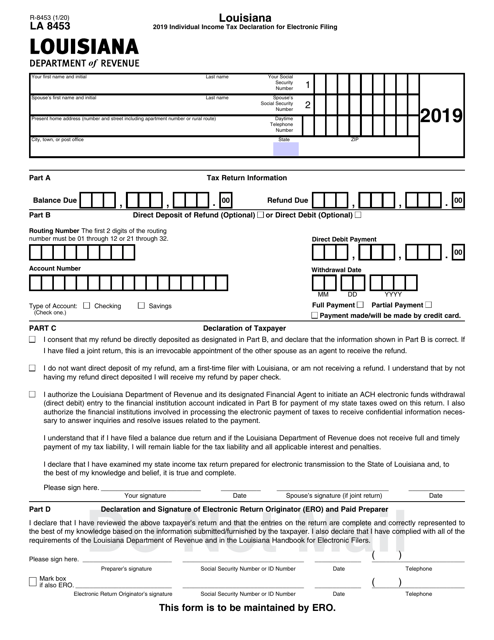

Louisiana requires you to pay taxes if youre a resident or nonresident who receives income from a Louisiana source.

. For assistance with inheritance tax questions call the Inheritance Gift and Estate. An inheritance tax return Form IETT-100 must accompany this affidavit if the gross estate is 15000 or more or if any taxes are due. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax.

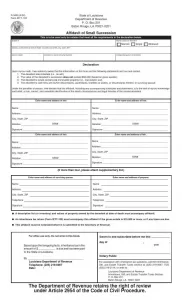

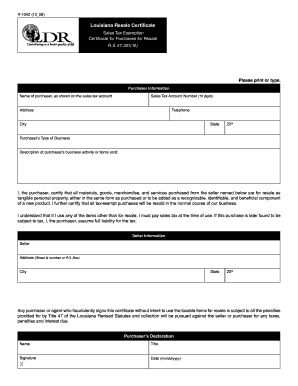

Form R-1310 Download Fillable Pdf Or Fill Online Certificate Of Sales Tax Exemption Exclusion For Use By Qualified Vehicle Lessors Louisiana Templateroller Please check this page regularly as we will post the updated form. For Completing the Louisiana Inheritance and Estate Transfer Tax Return R-3318 General Information 2 Optional Procedure for Small Estates In any case where the gross value of the succession does not exceed 50000 the Secretary may in his discretion fix and collect the tax upon an affidavit filed by the succession representative or heirs. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more.

R-3405 402 State of Louisiana Form IETT-103. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2.

Credit Caps See the estimated amount of cap available for Solar tax credits and Motion Picture Investor and Infrastructure tax credits. Do not write in this block. Separate Property in Louisiana Inheritance Law.

Ad Download Or Email Form LAT05 More Fillable Forms Register and Subscribe Now. The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. Bulk Extensions File your clients Individual Corporate and Composite Partnership extension in bulk.

Download past year versions of this tax form as PDFs here. R-3318 1108 1402 Schedule IV Tax Reduction and Determination of Louisiana Estate Transfer Tax 1 Total state death tax credit allowable Per US. Federal estatetrust income tax return due by April 15 of the year following the individuals death.

An inheritance tax return Form IETT-100 must accompany this affidavit if the gross estate is 15000 or more or if any taxes are due. The state income tax rates for the 2021 tax year range from 20 to 60 and. For office use only.

Domesticated or income from louisiana. Louisiana department of revenue inheritance gift and estate transfer taxes section p. Ad We Support All the Common Tax Forms and Most of the Less-Used Forms.

We have a total of ten past-year versions of Form REV-1500 in the TaxFormFinder archives including for the previous tax year. In this detailed guide of Louisiana inheritance laws we break down intestate succession probate taxes what makes a will valid and more. The estate would then be given a federal tax credit for the amount of state estate taxes that were paid.

Louisiana Consumer Use Tax Return 01012021 - 12312021. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2 4 Basic inheritance tax From Schedule III 5 Tax reduction under Act 818 of 1997 See instructions. Box 201 Baton Rouge LA 70821-0201.

Addresses for Mailing Returns. Schedule of Ad Valorem Tax Credit Claimed by Manufactures Distributors and Retailers for Ad Valorem Tax Paid on Inventory or Natural Gas. 2021 Form REV-1500 Inheritance Tax Return - Resident Decedent REV-1500 2020 Form REV-1500 Inheritance Tax Return - Resident Decedent REV-1500 2019 Form REV-1500.

The amount of the state estate tax is equal to the federal estate tax credit allowed for state death taxes. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2 4 Basic inheritance tax From Schedule III 5 Tax reduction under Act 818 of 1997 See instructions.

In its most basic form separate property. How is estate transfer tax calculated. The estate transfer tax is only imposed on estates that are subject to federal estate taxation under the Federal Internal Revenue Code.

Yes Louisiana imposes an estate transfer tax RS. The louisiana estate transfer tax is designed to take. 1 Total state death tax credit allowable Per US.

This affidavit must be notarized before it is submitted to the Secretary of Revenue. In 2001 federal law changed and no longer permitted a federal tax credit for taxes paid to the state. An inheritance tax return Form IETT-100 must accompany this affidavit if the gross estate is 15000 or more or if any taxes are due.

Department of Revenue. Find out when all state tax returns are due.

Free Louisiana Power Of Attorney Forms Pdf Word

Form R 1323 Download Fillable Pdf Or Fill Online Sales Tax Exemption Certificate For Purchases Of Food Items By Certain Nonpublic Schools Or Nonprofit Organizations Louisiana Templateroller

Louisiana Inheritance Tax Estate Tax And Gift Tax

Free Louisiana Revocable Living Trust Form Pdf Word Eforms

Louisiana Inheritance Laws What You Should Know Smartasset

Louisiana Sales Tax Exemption Form Pdf Fill Online Printable Fillable Blank Pdffiller

Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Louisiana Small Succession Fill Out Printable Pdf Forms Online

R 1064 Louisiana Fill Out And Sign Printable Pdf Template Signnow

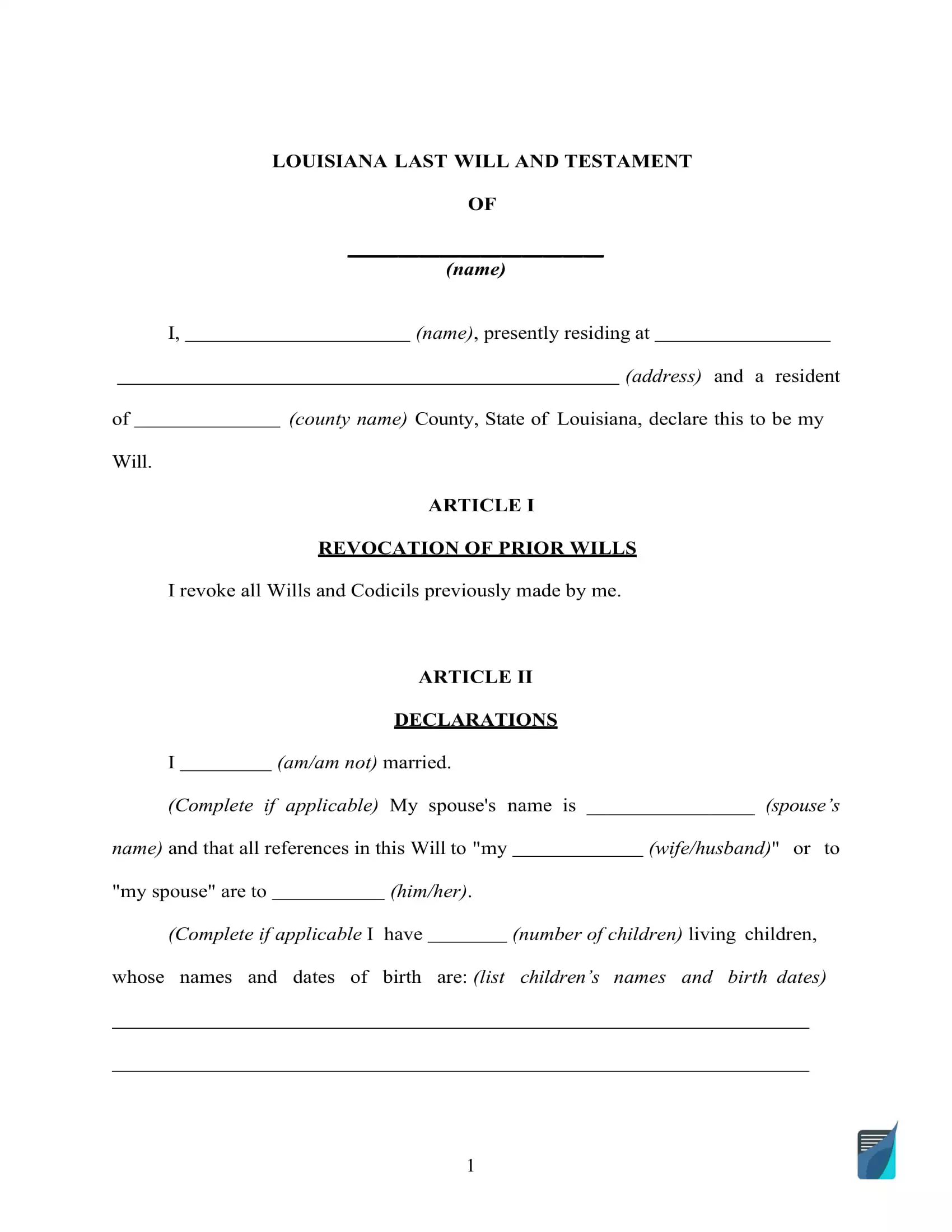

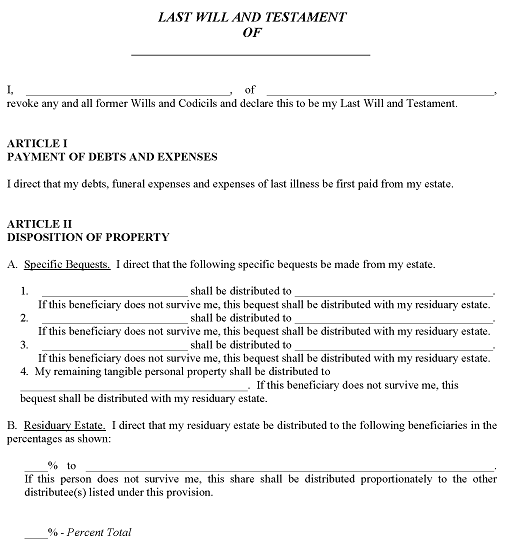

Fillable Louisiana Last Will And Testament Form Free Formspal

Louisiana Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Louisiana Hotel Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Free Louisiana Wills And Codicils Pdf Word Free Printable Legal Forms

Louisiana Estate Planning Will Drafting And Estate Administration With Forms Lexisnexis Store

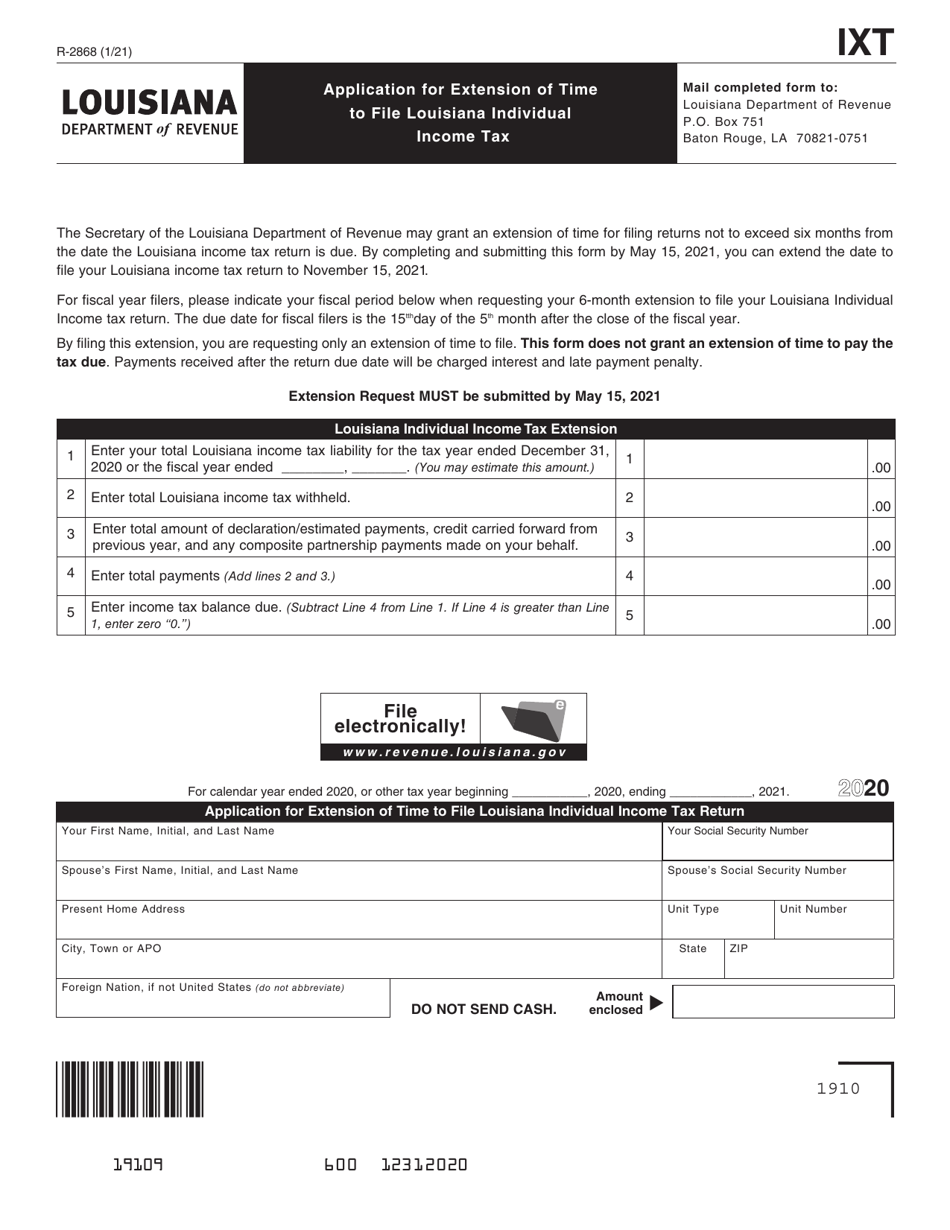

Form R 2868 Download Fillable Pdf Or Fill Online Application For Extension Of Time To File Louisiana Individual Income Tax 2020 Louisiana Templateroller